Of the 16 new-age stocks under Inc42’s coverage, excluding Zaggle which listed on Friday this week, 13 slumped in a range of 1% to over 8% on the BSE

Despite pressure in the broader market amid hawkish commentary from the US Fed and India-Canada political tensions, EaseMyTrip, Nazara, and DroneAcharya gained this week

Benchmark indices Nifty 50 and Sensex slumped in all four sessions this week, falling over 2.5% each

Indian new-age tech stocks slumped this week as bearish sentiment loomed over the broader domestic market amid hawkish commentary from the US Fed on interest rates and India-Canadian political tensions.

Of the 16 new-age stocks under Inc42’s coverage, excluding Zaggle which listed on the bourses on Friday, 13 fell in a range of 1% to over 8% on the BSE this week.

CarTrade Technologies was the biggest loser this week, falling 8.1%, ending Friday’s session at INR 545.5 on the exchange.

Besides, others like Zomato fell 3.1%, Paytm was down 3.7%, Nykaa slumped 6.5%, Delhivery 1.6%, and PB Fintech fell 2.5%.

It must be noted that four of these new-age tech startups – Zomato, Paytm, Nykaa, and Delhivery – have Canada Pension Plan Investment Board as one of their investors. While analysts so far believe that the souring ties between Canada and India would not immediately lead to any significant pressure on these stocks, the analysis might change if the tensions escalate further.

Meanwhile, despite the pressure, EaseMyTrip, Nazara Technologies, and DroneAcharya gained this week. EaseMyTrip emerged as the biggest winner this week, surging over 7% on the BSE.

In the broader market, benchmark indices Nifty 50 and Sensex slumped in all four sessions. While Nifty 50 fell 2.57% to 19,674.25, Sensex declined 2.7% to 66,009.15 this week.

The market was closed on Tuesday (September 19) on account of Ganesh Chaturthi.

Commenting on the weekly performance, Siddhartha Khemka, head of retail research at Motilal Oswal, said the sharp surge in the US bond yields following the Fed’s decision to maintain a higher interest rate stance and heavy selling by Foreign Institutional Investors (FIIs) led to profit booking in the market.

“We expect the market to remain under pressure in the near term given the global concerns. Thus, we suggest investors to have higher allocation towards defensive and large caps,” said Khemka.

He also opined that investors would look for economic data like US and UK GDP numbers, EU inflation, US and China manufacturing PMI, and India’s infrastructure output for further direction.

Meanwhile, pointing at the deteriorating ties between India and Canada, Arvinder Singh Nanda, senior VP at Master Capital Services, said it would become important to watch the investments of the Canadian Pension Plan Investment Board of INR 1.74 Lakh Cr in India.

“It is expected that if this tension further escalates, it can create some pressure,” Nanda added.

Amid all these uncertainties, Zaggle made a muted debut on the stock markets on Friday (September 22). The shares listed at INR 164 on the NSE and INR 162 on the BSE as against its issue price of INR 164 per share.

Shares of traveltech startup Yatra are expected to list on the stock markets next week.

Now, let’s take a look at the performance of some of the new-age tech stocks this week.

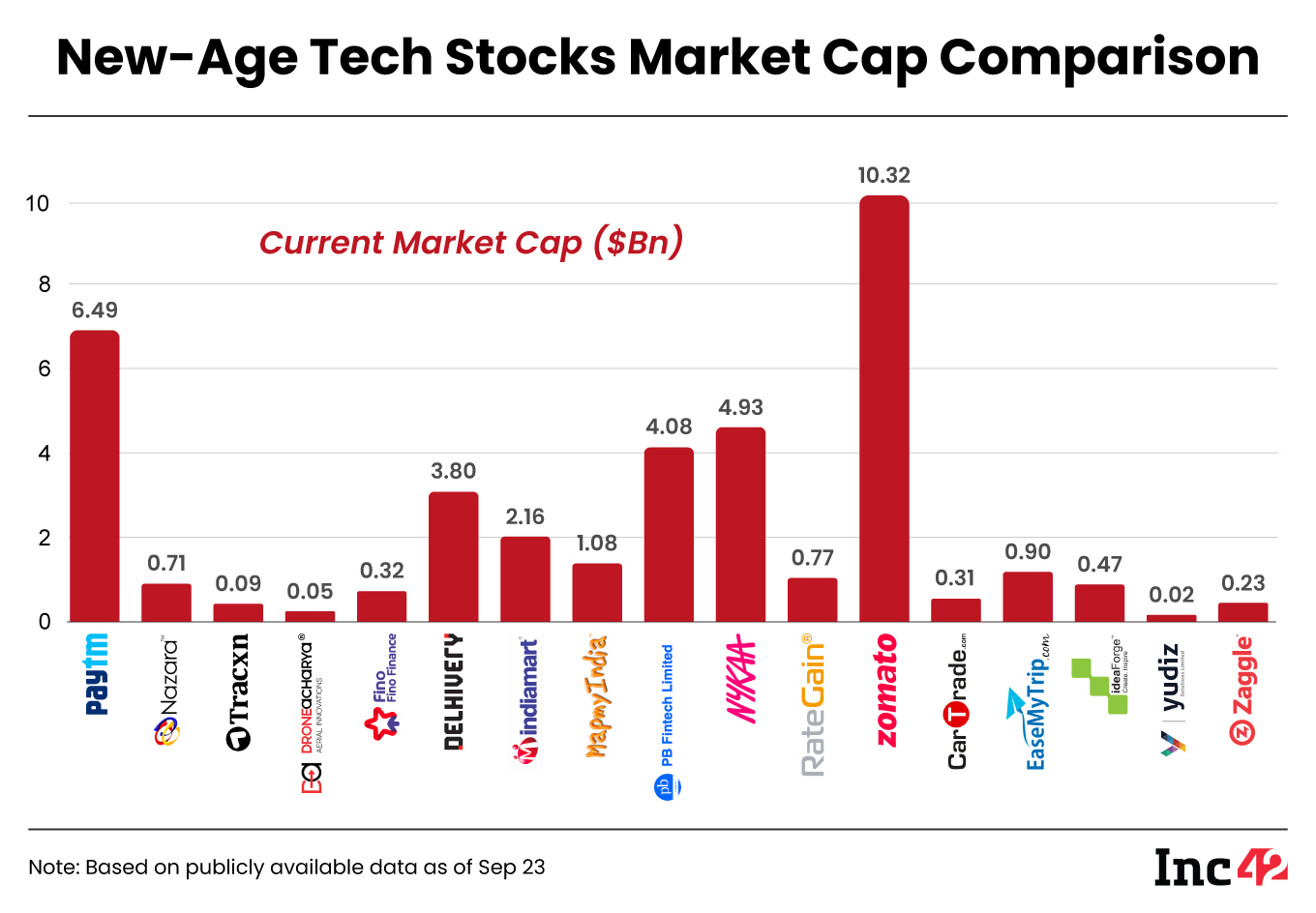

The 17 new-age tech stocks currently under Inc42’s coverage ended the week with a total market capitalisation of $31.74 Bn as against 16 of them ending last week at $36.05 Bn.

EaseMyTrip Regains Momentum

Ahead of the listing of its competitor Yatra, shares of traveltech startup EaseMyTrip jumped sharply this week. In the first trading session of the week, the stock surged over 12%, closing at INR 44.76, a level last seen in early June.

Though the shares shed some of their gains in the next trading sessions, EaseMyTrip was up 7.1% overall on the BSE this week.

It must be noted that while most new-age tech stocks, especially the ones that were battered last year, have witnessed a significant uptrend this year, EaseMyTrip shares have failed to make any gains so far this year.

In fact, the traveltech major’s shares are trading down over 18% year to date (YTD).

Meanwhile, EaseMyTrip announced new discounts and sales on its platform this week.

In its Golden Bharat Travel Sale, which will take place from September 19 to September 26, travellers can save up to INR 2,023 on domestic flight bookings, up to INR 7,500 on international flights, up to INR 10,000 on hotel bookings, and more.

It is further pertinent to note that the company’s profit after tax (PAT) declined 21.8% to INR 25.9 Cr in Q1 FY24 from INR 33.1 Cr last year on the back of a sharp increase in customer discounts.

EaseMyTrip also announced the launch of a smart voice assistance tool this week to enhance the booking experience on its platform.

Zomato’s Experiments Continue

After introducing a platform fee to shore up its revenue, Zomato has now introduced a feature where customers can tip the kitchen staff in restaurants on ordering food.

As a part of this new experiment, Zomato said that it would allow customers to pay 3%-10% of the order value as a tip. However, the company clarified that it would not keep any commissions from the tip amount.

The food delivery platform would remit the tips to the restaurants, after deducting any applicable taxes.

Zomato has earlier faced backlash for high commission fees on its platform. Hence, such a step could be a strategic one to attract restaurants to sign up on Zomato – particularly at a time when the company is aggressively focussing on its profitability.

However, Zomato shares were largely bogged down by the pressure in the broader market this week. After touching a new 52-week high at INR 105 during the intraday trading on Monday, the shares lost their gains. Overall, the shares fell 3.1%, ending Friday’s session at INR 99.85 on the BSE.

However, it must be noted that Zomato shares have gained almost 90% in just six months. Shares are up 68% YTD.

Commenting on the stock, Rupak De, senior technical analyst at LKP Securities, said Zomato is facing some resistance at around INR 103. Below this level, the stock will continue to witness selling pressure.

Nazara Shows Resilience

Nazara was the second biggest gainer this week as its shares surged over 6% on Tuesday alone. Though the stock was volatile, overall it managed to gain 4.8% during the week on the BSE.

Speaking to Inc42, Nazara Technologies CEO and joint MD Nitish Mittersain said this week that the company is looking to raise the freshly-raised capital from Kamath brothers of Zerodha and SBI Mutual Fund to acquire more gaming studios to strengthen its gaming intellectual property (IP) rights.

Despite difficulties increasing for the real money gaming companies on the back of increased GST rate, Mittersain said Nazara would not scale down its presence in the sector as it invests more in acquisitions.

While shares of Nazara faced pressure in the stock market in July after the government’s decision on GST, the stock has been on an upward trend since last month.

Shares of Nazara are up 51% YTD.

LKP Securities’ De believes that Nazara’s bullish trend is likely to continue and the stock might reach INR 1,000 level in the short term. Support for the stock is at INR 830, he added.

Nazara’s annual general meeting (AGM) is scheduled to be held on September 29.